People usually think they need a lot of money to achieve financial freedom. That’s partially correct, but along with money, conscious decision-making is also important here.

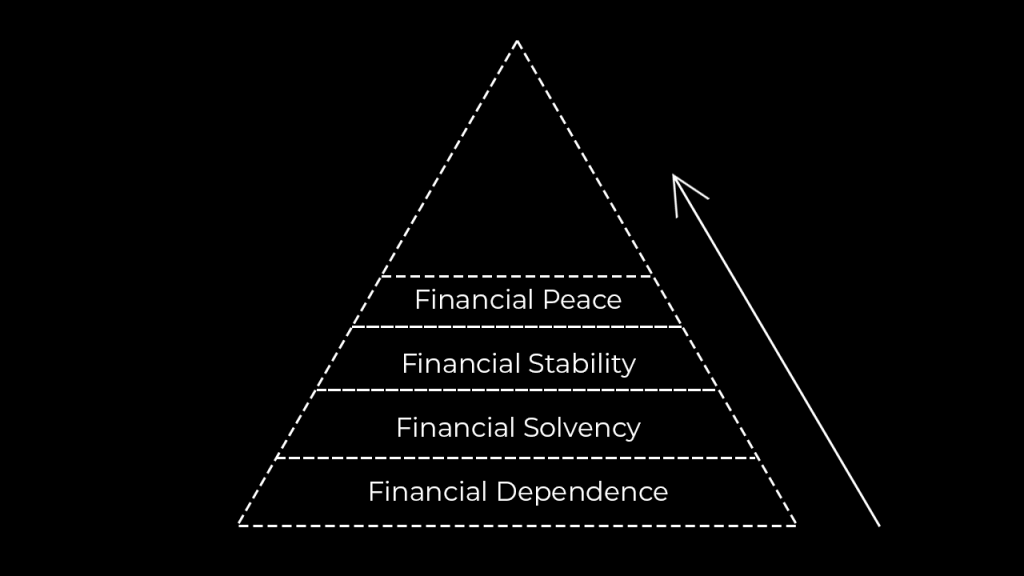

Financial betterment is not a binary event which would take a poor man to a rich man directly. One has to go through different stages in their life to achieve this sort of financial abundance.

I will try to explain all the different stages that need to be crossed to achieve financial abundance in your life. It’s not easy as we think for being committed to these goals.

But I am sure they are doable! that’s how rich people became rich and stay continued as rich. Here are the different stages in your financial journey and you can compare them with your own journey to figure out your progress.

1. Financial Dependence

Most people start with a job in their career after 18 years of formal education. I am not talking about the entrepreneur minds here, they are different breeds.

A formal job can only make people live from salary to salary and they may find it super difficult to meet both ends of life. This will only help people to meet their basic needs. Knowingly or unknowingly people are running their rat race here.

People usually start working hard for promotions and better appraisals, but they slowly realise none of that efforts could beat inflation and tax in the market.

The only survival mantra at this stage would be to increase your income and reduce your expenses. There is a limit to you can cut your expenses. But the only way one can progress to the next stage would be by looking for additional income from side hustles.

You are in this stage, if you experience the below situations.

- Financially depended on your job with a basic income.

- Living salary to salary without much savings.

- Need to borrow money for emergency needs.

- Mostly expenses are greater than your income.

2. Financial Solvency

This is the stage where people start earning more than their expenses. Most of them would have established an emergency fund at this stage to meet the unplanned expenses.

Millennials and GenZ are directly landing high-paying jobs ( I know this is not the situation for all) in the market which would help them to directly start with this stage in their financial journey.

People feel more control over their finance here, but some might need to work on establishing their emergency funds.

I would recommend starting with a liquid fund or fixed deposit in the bank to keep the contingency fund for rainy days.

You can definitely experience the below situations at this stage.

- Earnings are always more than expenses.

- Established an emergency fund for unplanned situations.

- No need to borrow money for basic needs.

- You feel more control over your money.

3. Financial Stability

Stability is an indication of your establishment in your career. By this time you would have spent enough years to make a steady flow of income to your bank account.

It is a common man’s right to take loans in their life for big expenses. Education loans and vehicle loans are very common at this stage. But people will make a conscious decision not to make additional debts from this stage onward.

Not adding more liabilities only will make progress to the next stage and this would bring more control over net worth. Only committed people can make an improvement from here. Otherwise, people used to loop between solvency and stability.

You can set the benchmark if you observe the below situations.

- Not adding any new debt to your financial journey.

- Established in a career with a steady flow of income.

- Matured enough to take conscious financial decisions.

4. Financial Peace

Debt freedom is the main milestone of this stage. Financial peace is the dream for many people in the world but unfortunately, it will remain a dream for many.

This is the first glimpse of financial freedom as you no longer need to work for paying your creditors. You are absolutely free from your liabilities and that gives you enough room to think about managing your money in your own way.

This is the stage where things can get into the wrong shape as well if people are not controlling their needs against wants.

Buying a phone could be a need but buying iPhone might be a want. Similarly, buying a car would be a need, but looking for a BMW or Mercedez Benz is a want.

You are ready for the next stage if you experience the below things

- Completely debt free and with no liabilities.

- Matured enough to handle impulsive decisions on wants.

- Positive net worth figures.

5. Financial Security

People at this stage have enough money to maintain a comfortable and affordable lifestyle without worrying about money.

This is the right time in your financial journey to look for a modest house, take big vacations that can last for weeks, Investment in real estate and have more aggressive portfolios in equity and mutual funds.

It is pretty common that people to give up at this stage and choose to go with the comfort level they are experiencing right now. Essentially, it’s a relaxing stage after big firefighting for almost a decade for many. So, it’s obvious that people can turn a little lazy here.

You can easily relate to this stage if you are

- Not worried about your income with respect to your current lifestyle.

- You can afford most of your lifestyle needs.

- Mentally prepared for big investments.

6. Financial Independence

Damn! you are longer dependent on your salary anymore. This is the real beauty of financial independence.

This is the stage where your cash flow from all your investments and business beats your lifestyle expenses. You no longer need to work under an employer, but that doesn’t necessarily mean you need to be completely out of a job.

You can still work but on your own terms with all the flexibilities irrespective of the physical location (in most cases). Your surplus income will take care of all your expenses as your net worth is a significant figure by now.

Diversification is the most important thing to take care of at this stage to ensure a steady inflow of money to you. It should be always a mix of fixed-income and long-term asset classes.

You can declare yourself as financially independent if you meet the below conditions.

- Your surplus income is greater than your lifestyle expenses.

- You have made a large corpus as your net worth.

- You no longer need to work for earning money.

7. Financial Freedom

Financial freedom is the ultimate goal for anyone who wants to be successful in their financial journey.

There is a big difference between financial independence and financial freedom. I have noticed people using these terms interchangeably but they are different.

In financial independence, one can only live a planned comfortable life with projected expenses. It wouldn’t be possible to deviate a lot from the lifestyle. On the other hand, financial freedom will give the absolute freedom of upgrading life.

People can try out their costly hobbies now, follow their passion without worrying about money, spend on luxury experiences etc.

You are enjoying freedom if you can relate to the below situations.

- Spend extravagantly on things you like in your life.

- Chase your dreams and luxurious moments.

- You will consider donating money more generously.

8. Financial Abundance

A person would have reached a multi-millionaire status to experience financial abundance. Their business empire and high net worth make them qualified for this lifestyle.

People in financial abundance use a bigger portion of their money to start and operate their businesses to maintain the lifestyle they are in.

People follow the below traits when they are financially abundant.

- Delegate everything and spend more time with family than before.

- Most people will consider donations or charity initiatives.

- People would have created generational wealth.

10 comments