All investment avenues in India needs KYC compliance from Investor. PAN card is an inevitable document to start with the KYC. Unfortunately a lot of people procrastinate their investment decisions only because they don’t have a PAN card.

PAN card should not be a show stopper for your investments. Through this blog, I can help you to get your PAN card easily as a Resident Indian with your Aadhaar card.

Prerequisite to apply PAN card online

- A valid Aadhaar card linked with mobile number and email address

- PAN card details will be generated from Aadhaar card hence, make sure Aadhaar card details are up to date including your photo.

How to apply PAN card online ?

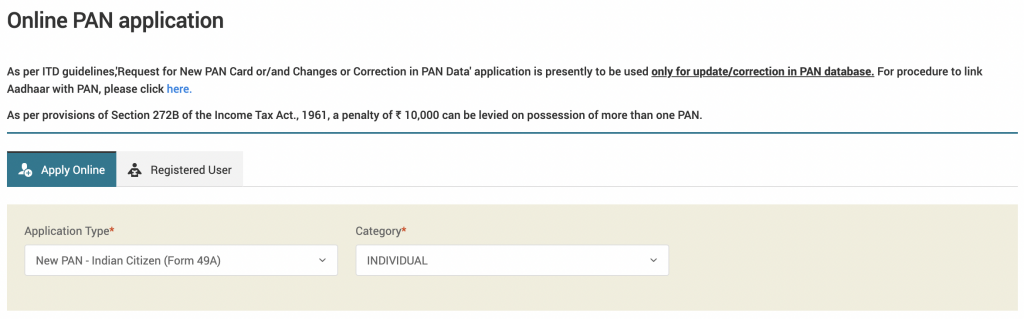

There are different entities like NSDL, Income Tax India, UTI are offering online PAN applications. In this article we are using the NSDL platform for apply PAN card online.

Step 1 : Open the NSDL portal for online application

Step 2 : Select the Apply Online tab and choose the application type as “New PAN – Indian Citizen”. Choose the category as Individual

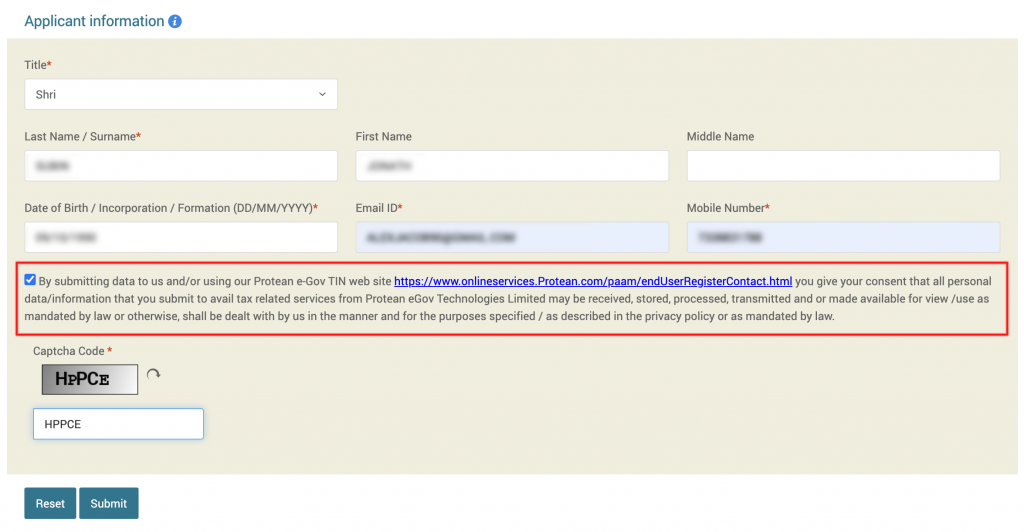

Step 3 : Under the Applicant information tab, fill your appropriate details. Don’t forget to select the checkbox and type the captcha code in the below box. Click submit button to proceed.

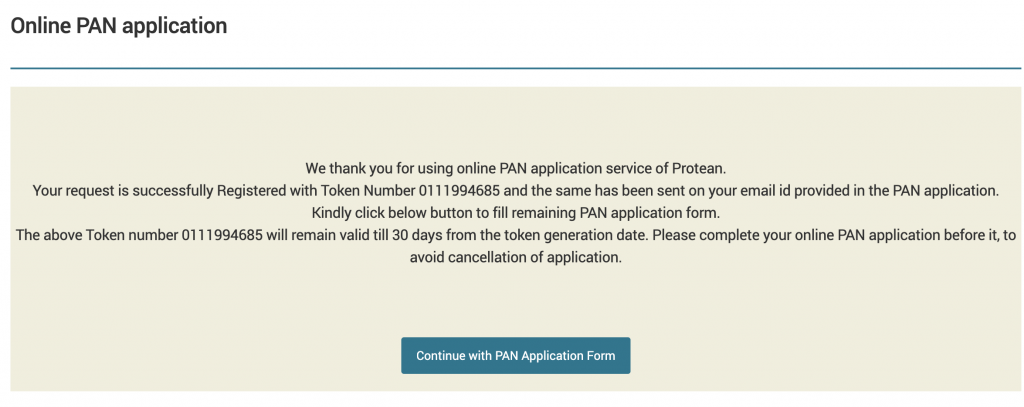

A token number will be generated after submission for future reference. Token is valid for only 30 days. Applicant can use token number to continue the application later. Let’s Continue with PAN application Form

PAN Card Application Details

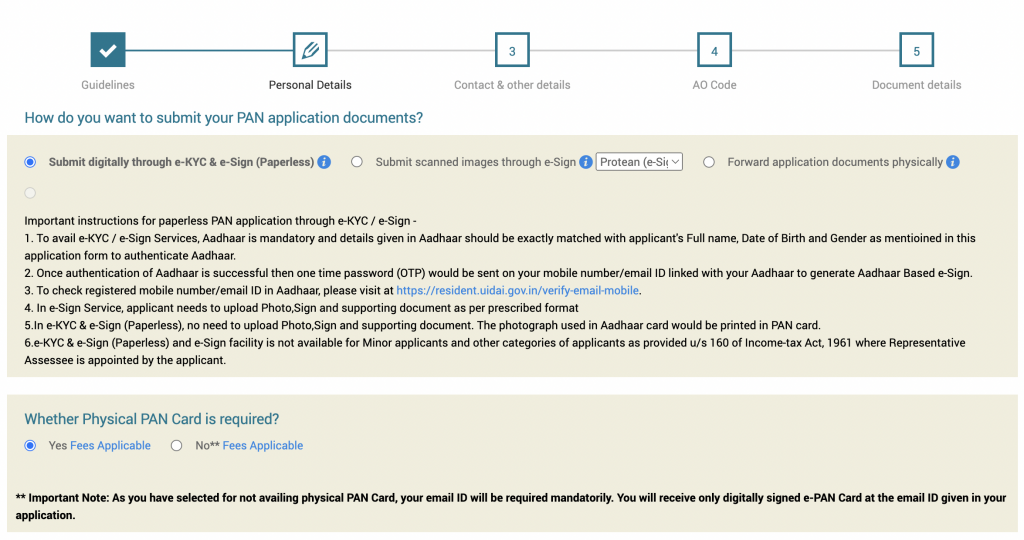

Step 4 : Choose the digital submission option as shown below. This will help us to apply for paperless PAN card completely online.

If a physical PAN card is required, choose Yes (A fee is applicable for this, which needs to be paid online before the final submission of this application).

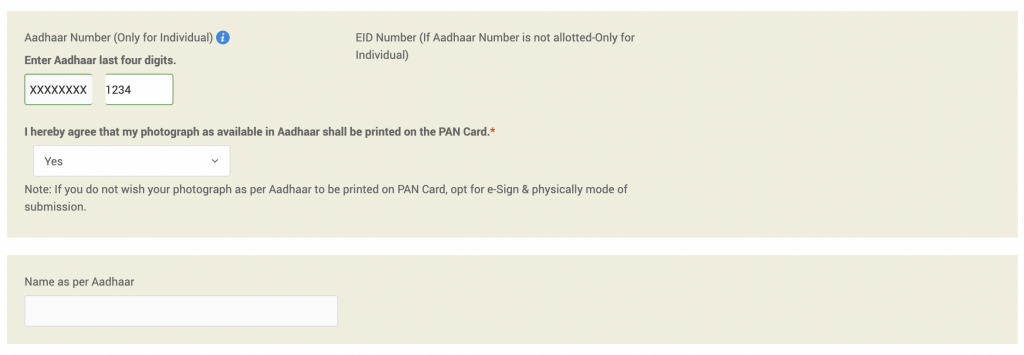

Step 5 : Enter the last 4 digits of your Aadhaar number. New PAN card will print same photograph from Aadhaar card( You can also proceed offline method if you need customisations)

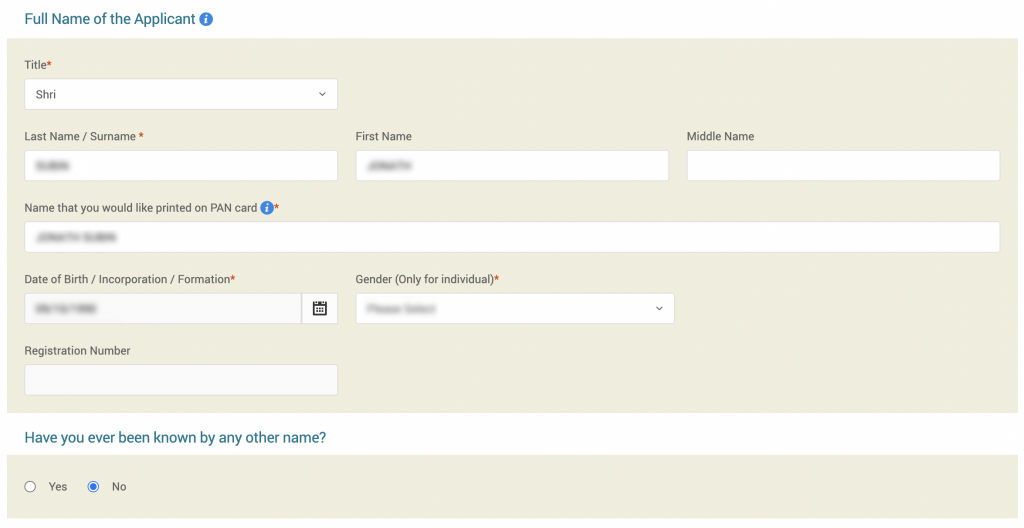

Step 6: Fill the PAN applicant details. Please make sure the name and date of birth is as per the PAN card.

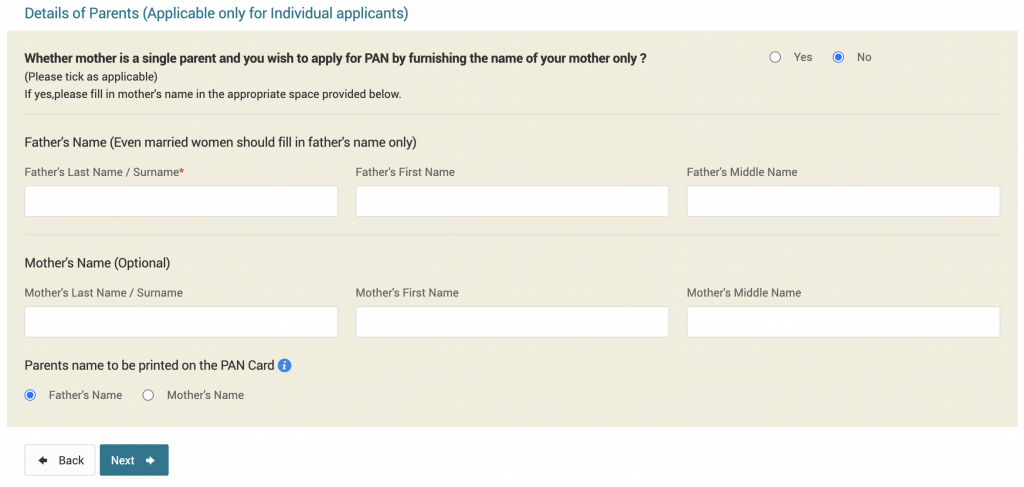

Step 7 : Fill the details of the parents and choose whose name should be printed on their PAN card. Click Next to proceed further.

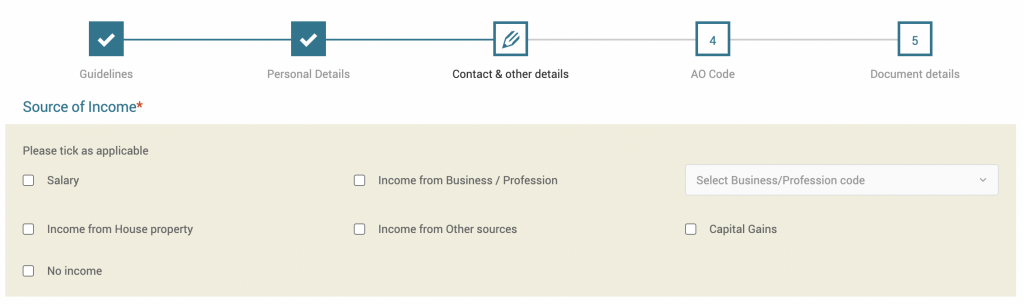

Step 8 : Fill the income details of the applicant properly.

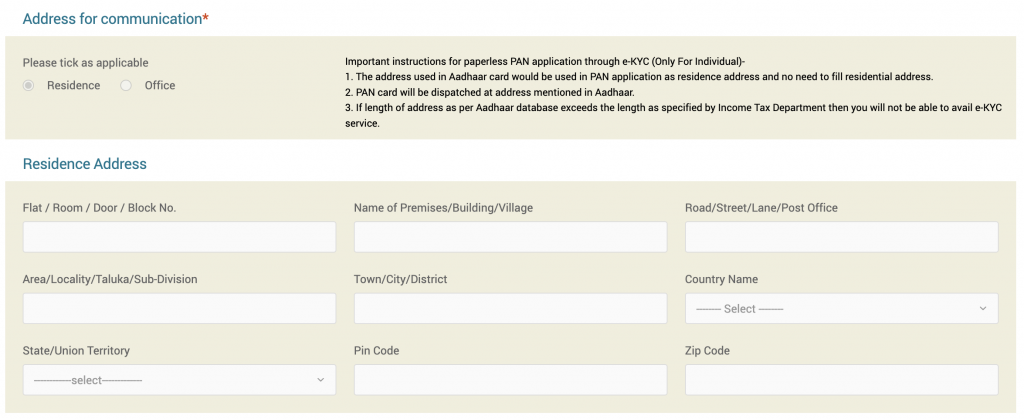

Step 9 : Fill the the permanent and communication address. There is an option to provide Residence and Office address in the form. Application has an option to provide the permanent address and communication address separately. Physical PAN card will deliver to this address.

Step 10 : Provide the email address and phone/mobile contact numbers.

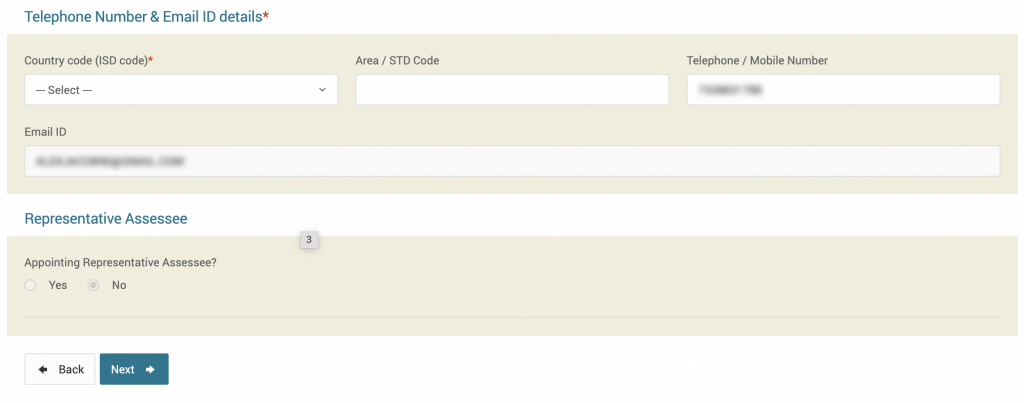

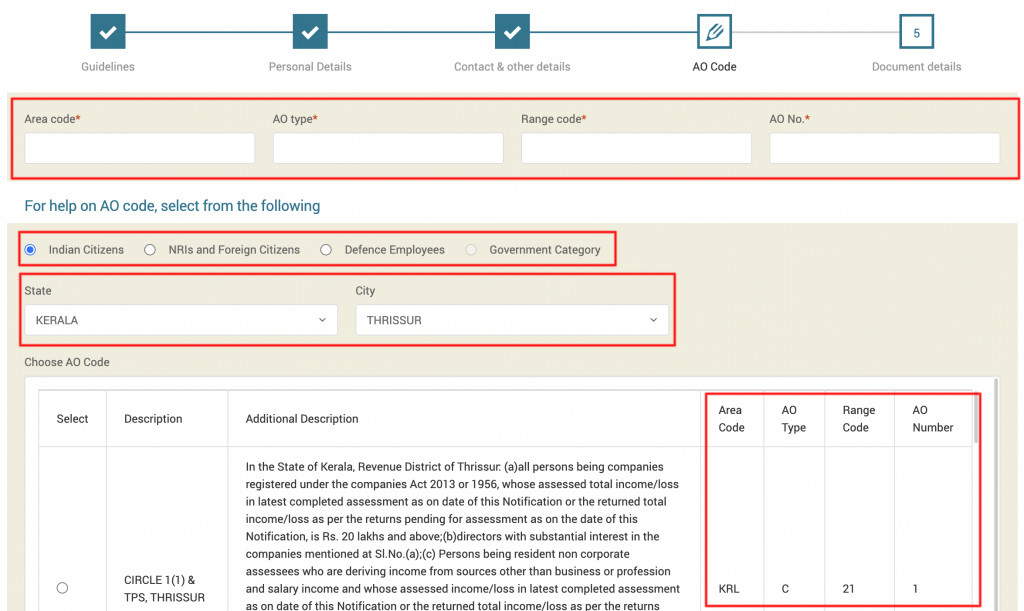

Step 11 : Fill the area code and range code details correctly. There are few options to find the correct area details within the application. Based on the citizenship, state and city one can find the area code details.

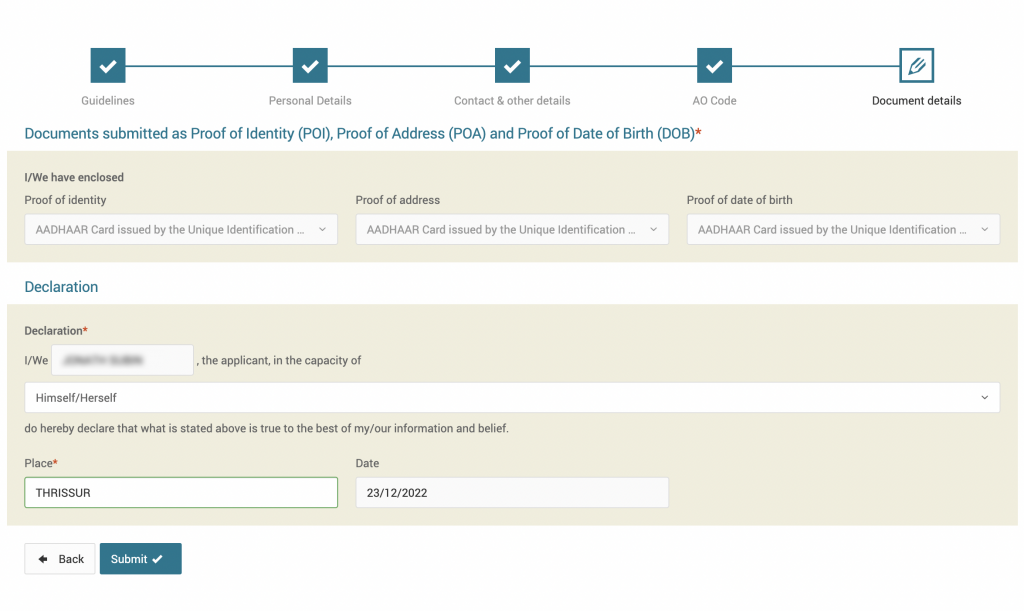

Step 12 : Fill the declaration section and submit the final application. A payment screen will appear for the applicants whoever requested physical PAN cards.

Conclusion

The physical PAN card may take a week or two to deliver based on the postal location of the applicant. Refund process is automatic, hence no need to worry about the payments failures. Applicant needs to submit the application within 30 days of receiving the token.